Four years back, Indians saw an intense change in the national monetary arrangement. The diverse duties were coordinated into one, making it work for everyday citizens. This was referred to as GST i.e., Goods and Services Tax.

This change in the tax structure caused an increment in the necessity of individuals with information on GST. The monetary firms began selecting applicants who had GST certification. Due to the popular demand of certified GST holders, the offline and online GST certification courses in Bangalore came into existence.

The GST registration certificate is a legal document that serves as proof of GST registration in India. Any business in India, whose turnover surpasses GST values is needed to get enrolled under GST. The Goods and Services Tax (GST) has been implemented across India, and it is up to taxpayers to become comfortable with this new method of paying taxes and filing returns.

Bangalore, also known as the ‘Silicon Valley of India’, has headquarters of major software companies. This indirect tax had to be understood through professionals by all sizes of business set-ups and organizations.

For individuals, it was a new way altogether as the taxpayer and for filing returns. Everyone had to unlearn the old ways of paying taxes and get accustomed to this enhanced concept of GST. To gain knowledge and implement the idea of GST, educational institutes both online and offline started offering GST certification courses across India.

We will be looking at what GST is and its purpose and advantages in this article, along with some good options for GST certification courses in Bangalore.

What is the Goods and Services Tax (GST)?

GST (Goods and Services Tax) is an indirect tax (often referred to as a consumption tax) imposed on the supply of goods and services in India.

Except for a few state taxes, it is comprehensive since it includes most indirect taxes. The GST, as a multi-staged tax, is levied at each stage of the production process, but it is intended to be reimbursed to all parties involved in the different phases of production except, the final consumer.

The indirect tax or GST was implemented by the Government of India on 01st July 2017. After its implementation, GST rates have been changed on various occasions, where a board of government and state finance chose to reconsider GST rates on 28 products and 53 services.

For tax collection purposes, goods and services are split into five tax slabs: 0%, 5%, 12%, 18%, and 28%. Petroleum goods, alcoholic beverages, and electricity, on the other hand, are not taxed under GST. They are instead charged individually by respective state governments, as per the old tax regime.

This implementation of GST simplified the whole scenario for most of the population. Following are a few important points about the same.

- Getting Rid of the Complicated Tax System: According to the government, GST has made life easier for not just business people and dealers, but also for those who manufacture goods and provide services. Because the tax system has been consolidated into a single entity, there will be far less uncertainty than there was previously.

- GST Submitting System with Less Human Effort: Almost all of the processes involved in filing a GST have been moved online, decreasing the amount of manual work required. Human mistake, which was previously unavoidable, has been minimized as a result of technological intervention.

GST Laws

The GST launch was a historic moment for the nation. The GST council approved the following bills after which the Goods and Services Tax was brought into effect throughout the nation.

There are 4 Elements of GST:

- Central Goods and Services Tax (CGST): Central Goods and Services Tax is collected by the Central Government within the state. The state and center share the revenue generated.

- State Goods and Services Tax (SGST): The state government levies the state tax on the transaction of goods and services. The revenue collected belongs to the respective state government.

- Integrated Goods & Services (IGST): The imported and exported goods and services between states attract

- Union Territory Goods and Services Tax (UTGST): It has the same benefits as SGST. This tax applies to the union territory’s goods and services.

In the union territories like Chandigarh, Daman and Diu, Dadra and Nagar Haveli, Lakshadweep and Andaman and Nicobar Island, UTGST is an applicable exception being Delhi and Puducherry where they have their own set of rules.

The Government of India Collects 2 Main Types of Taxes –

- Direct Taxes – Direct tax as imposed on income and profits, literally means taxes that are paid directly to the government like property tax, income tax, etc.

- Indirect Taxes – Indirect taxes are levied on manufacturers or suppliers of goods and services. There are many types of indirect taxes namely sales tax, excise tax, customs tax, value-added tax, entertainment tax, etc.

GST constitutes all the indirect taxes. Although, there are some advantages and some disadvantages of GST.

Advantages Being:

- The collection has been easier since various taxes have been consolidated under the GST platform, resulting in uniform compliance procedures across the country.

- The estimated tax burden on businesses has decreased in recent years.

- Tax evasion is reduced, and tax collection is improved, resulting in increased GDP.

- The whole taxation system’s transparency has increased, and the negative chain of consequences caused by the previous tax approach has been abolished.

- Due to a drop in the tax on goods transportation, logistics experienced a rise in business transactions, resulting in faster merchandise movement across borders.

- The GST registration process is simple and compatible with all digital requirements.

Disadvantages Being:

- Hiring a professional to deal with small business finance might increase the cost of an operation to file the GST according to the government’s guidelines.

- With the implementation of GST, businesses are required to upgrade to the most up-to-date ERP software, raising their operational costs.

- Training personnel necessitates time and effort commitment.

- Small businesses with limited resources confront a significant challenge in complying with and adhering to the GST filing date.

Who can Pursue a GST Certification Course in Bangalore?

As stated above, the GST laws keep changing as they are still new and improving by the day. Thus, the need for GST-certified professionals to help taxpayers was made available by the government. Therefore, education institutes have started online GST certification courses.

If you are an accounting or finance professional you have an added advantage. Graduates, freshers, housewives, retired professionals, business owners, students can also pursue the online GST certification courses in Bangalore.

To find out about the institutes that offer online GST certification courses in Bangalore, the following is the list of some of the best institutes.

- IIM Skills

- Institute of Chartered Accountant of India (ICAI)

- Udemy

- myTectra

- CAclubindia

- CFO Next Bangalore

- GST Training Bangalore

- RIA Institute of Technology

- Henry Harvin

1. IIM Skills:

IIM Skills offers high-quality online courses namely, digital marketing course, content writing course, and GST course, Technical Writing Course in Bangalore. It is extremely beneficial as they help you understand what GST is and the opportunities it creates for you.

The Master GST Certification Course will help you build a good foundation for a successful career. GST certification as a career requires professional training, which is a key takeaway at IIM Skills.

IIM Skills offers master certification which is recognized by the government of India. It comprises 4 weeks of live sessions, 16 hours of training, and assistance for placement. In addition to doubt clearing during the live online class, backup sessions are also available.

The best part is your assignments are reviewed by an expert mentor. The feedback is given on assignments. Technical knowledge is also provided by industry experts.

Course: Online GST Master Certification Course

Curriculum:

- Introduction and types of GST

- Framework and structure of GST

- Rules and regulations of registration under GST

- Invoicing in GST

- Different kinds of GST Returns Filing

- Input tax credit and payment in GST

- E-way bill under GST

- Composition scheme under GST

- Reverse Charge mechanism

Along with the GST certification course, IIM Skills also offer courses in content writing and digital marketing. The institute also is first on this list of online GST certification courses in Bangalore because of its attractive affordable price!

The following certificate is received on completing the GST certification course.

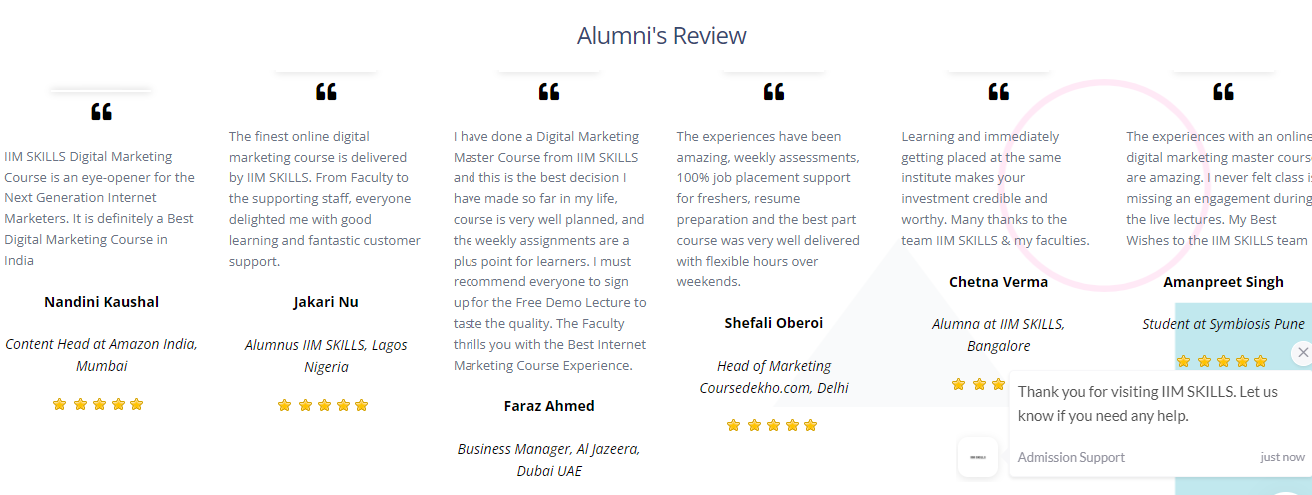

Reviews and Testimonials by the Alumni

Brand Collaborations For Placement Assistance

Course fee – INR 9900 (GST Excluded)

This form is currently undergoing maintenance. Please try again later.

Also, check out Business Accounting and Taxation Courses in Bangalore

More Courses from IIM SKILLS

Business Accounting And Taxation Course

2. Institute of Chartered Accountants of India (ICAI)

The Institute of Chartered Accountants of India (ICAI) is the world’s second-largest professional accounting and finance organization. It holds a reputation for academic and professional advancement. Only members of the ICAI are eligible to take the GST certification course. The GST certification course at ICAI is one of the best.

Course: GST Certification Course

At ICAI, the enrollment in courses is based on a first-come, first-served basis. Faculty members are chartered accountants, academicians, and advocates with extensive expertise and knowledge.

Members of the chartered accountant’s institute or those who have passed the CA examination finals are eligible. The course is also open to candidates in the fields of service and auditing. The course lasts 10 days and is available on weekdays or weekends, with a different course fee for cities according to tiers 1,2, or 3.

Curriculum

- Understanding concept of GST, levy

- Overview of GST

- Input tax credit

- Registration

- Refund

- Offenses

- Penalties

- Customs duty

- Valuation

- Time and place of supply

Check out the 10 Best GST Certification Courses in India

3. Udemy

Udemy has several GST courses available that may be accessed from anywhere in the world. The biggest benefit of this platform is that it allows candidates who are unable to attend in-class sessions to complete the course at their own pace. That is why Udemy also is on the list of GST certification courses in Bangalore.

It also provides a few free GST courses for those who want to learn the basics of the subject. The training is open to GST practitioners and accountants, compliance executives, and students with CA/CS/CMA/MBA degrees.

Udemy seeks to open up new opportunities for individuals and businesses by offering a platform for them to improve their abilities and stay current with developing technology to succeed in an ever-changing environment.

Topics:

- E-way bill

- Audit

- E-commerce

- Input tax credit

- Tax invoice and registration

- Refund

- TDS

- Time and value of supply

- Recovery

- Penalties

4. myTectra:

myTectra is a well-known global learning institute with a strong presence in the training industry. It provides offline training, corporate training, instructor-led training, and round-the-clock support in more than ten cities across the world.

Freshmen and professional hopefuls will benefit most from the technology and business courses. myTectra offers a variety of programs, including IT classes, leadership programs, business courses, and digital marketing courses, among others.

myTectra offers one of the best online GST certification courses in Bangalore under the finance category of business education. The offline courses are also available at the Bangalore location.

Course: GST Certified Professional Training

Curriculum:

- GST Overview

- Resolution of a query

- CGST, SGST, and IGST

- GST Law Requirements GST Accounting Impact CGST, SGST, and IGST Understanding

- CBEC’s efficient planning and recommendations for GST-ready Draft Rules

- Implementation strategies that work

The certificate is awarded on course completion. Backup and rescheduling classes are available if you miss one or more classes. 100% aid with job placement is provided. Internships on live projects are as beneficial as hands-on training. In the classroom, individual focus, originality, and interaction are all important.

5. CAclubindia

In 1999, a group of experts launched an interactive digital platform to unite the accounting and finance sector. In its finance and taxpayer community, they now have over 2 million members.

CAclubindia is a one-stop-shop for a wide range of professional courses, including CA, CS, CISA, CWA, CIMA, and other certification courses like GST, international taxes, financial modeling, and more. The GST certification course is one of the best GST certification courses in Bangalore, among its many offerings.

Course: Advanced GST Certification

Curriculum:

- GST registration

- Scope and Supply of GST

- Zero-rated supply

- Annual returns

- GST audit report

- Input tax credit

- Tax invoice

- Concept of input service distributor

- Intricacies supply

The certificate is awarded after the exam by the Ministry of MSME PPDC, after taking the mandatory online exam. The notes are given beforehand and the live session recordings can be only viewed twice.

6. CFO Next Bangalore

The syllabus includes the following:

- GST Key Definition

- Administration Of GST

- Time And Value Of Supply

- Payment Of Tax

- Refund Of Tax

- Input Tax Credit

- Tax Invoice

- Returns Assessment And Audit

- Transition Key Elements

- Inspection And Search

- Demand And Recovery Of GST

- Advanced Ruling

- Appeals And Revisions

- Place Of Supply Under IGST Law

- Prosecution Of Offences

- Compounding Of Offences, and others.

- The beginner’s course in GST is level 1 and the fee is INR 999

- The GST Practitioner course comprises level 2 of the learning process. The course fee is Rs 2999

- Finally, you have the advanced certification in GST which is level 3. Here the course is priced at Rs 4999.

7. GST Training Bangalore DBA

- Introduction And Details Of GST

- Scope Of Supply

- Time Of Supply

- Composition Scheme

- E-way Bill

- Valuation Of Supply

- Input Tax Credit

- Documents Format As Per GST Act

- Maintaining Books Of Accounts

- GST Returns

- GSTN Portal And Its Tools.

8. RIA Institute of Technology

- Input Tax Credit

- E-way Bill

- Tax Rates

- Value Of Goods

- Supply Of Goods

- Tax Returns

- Types Of GST

- Overview Of The Gst Process

- Tax Rates Among Others.

9. Henry Harvin:

The Henry Harvin GST certification course is one of the most realistic online GST certification courses available, and it has trained over 14,265 candidates to date.

It explains GST from beginning to end and prepares you for all of the complexities of GST implementation. The GST course is laid out in an easy-to-follow format, with plenty of practical examples and real-life case studies.

Students learn everything there is to know about GST laws, GSTR 3B, GSTR 2A, GSTR 1, electronic invoices, and a slew of other hot issues in the field. The curriculum also offers to resume writing in addition to soft skills development including the following modules.

- Module 1: Supply or Levy, Supply Location or Value, Import, E-Way Bills, or Export.

- Module 2: Input Tax Credit, Registrations, Transitional Provisions, ITC04, Job Work are all covered.

- Module 3: Invoice, Account & Records, Tax Payments, Returns, Time of Supply, and Refunds are all covered.

- Module 4: Audit & Assessments, Litigation Management, Demand & Recovery, Offenses & Penalties are all covered.

Apollo Tyres, L&T, HDFC Bank, Tata Power, and others are among the renowned corporate partners who trust Henry Harvin. The Henry Harvin Institute has an amazing professional alumni network of more than 15,000 talented people all over the country.

In addition, also check the top 10 online GST courses in India, to find out the best suitable option to pursue the career.

Frequently Asked Questions

- Who may register for the online GST certification courses in Bangalore?

Graduates, chartered accountants, company secretaries, financial and tax professionals, and freshers are all eligible to enroll in the GST certification courses in Bangalore.

- How much does a GST expert make?

In India, the annual income ranges from 5 to 7 lakhs. However, it differs depending on the workplace, experience, and skill set of the worker.

- What exam must we pass to become GST practitioners?

The National Academy of Customs, Indirect Taxes, and Narcotics (NACIN) holds a test for those interested in becoming Goods and Service Tax practitioners.

- What are a GST practitioner’s responsibilities?

He is responsible for GST registration, return filing, refunds, or any other associated payment, as well as providing data on inbound and outbound supplies.

Winding up: Concluding Thoughts on the GST Certification Courses In bangalore

From the listed institutes, you can opt for any. Additionally, weekday and weekend batches are available to accommodate working professionals. The features also include session records and video lessons.

As a result, you can apply for the course that is best suited to your needs based on your requirements and ease. There is a range of GST certification courses in Bangalore available, from basic to advanced.

The historic GST act has created a plethora of job opportunities for commerce graduates, tax advisors, and persons with financial and accounting credentials. Pursuing this course will only help ease out the complex process of tax paying and filing returns.

The course also guides you to professionally handle your hard-earned money. These GST certification courses in Bangalore will assist you in selecting from a variety of options available in the market. Furthermore, the course will be a solid additional qualification to your resume.