The Goods and Services Tax (GST) is intended to offer the much-needed stimulus for India’s economic growth by converting India’s present indirect taxation system into a free movement of goods and services within the economy and removing the tax-on-tax cascading effect. As a result, taking a GST certification course expands the number of career options open to you. Individuals might use it to create their own consulting firm. We can learn more about GST certification courses in Pune in this article.

Due to Pune’s status as India’s second-largest “IT powerhouse” and top “automobile and industrial hub,” various organizations have sprung up to provide legitimate and advanced GST certification courses as well as training to meet the needs of consumers and GST practitioners.

Many students from various fields, such as tax, finance, and accounting professionals, as well as business people, are learning the concepts of GST in response to this demand for skilled GST practitioners, as it is an inevitable part of the commerce and business world, as well as a new career opportunity for many students.

Before learning more about these certificate courses, it’s important to understand the background of the Goods and Service Tax, as well as its advantages.

What is GST in India?

It is an indirect tax that has mostly superseded several other indirect taxes in India, such as excise duty, VAT, and services tax. The Goods and Service Tax Act was enacted by Parliament on March 29, 2017, and came into effect on July 1, 2017.

In other words, the GST (Products and Services Tax) is a tax charged on the provision of goods and services. The Goods and Services Tax (GST) in India is a multi-stage, a destination-based tax levied on all value additions. The Goods and Services Tax (GST) is a single domestic indirect tax law that applies across the board.GST stands for Goods & Services Tax, which is a proposed national value-added tax and a planned comprehensive indirect tax levy on goods and services manufacture, sale, and consumption.

It will be used to replace all indirect taxes collected by the Indian federal and state governments on goods and services.

Advantages of GST:

The following is a list of the advantages of introducing GST in India.

1. Removes The Tax Cascade Effect

GST stands for Goods and Services Tax, and it was created to unite all indirect taxes under one roof. More significantly, it will eliminate the tax cascading impact that existed previously. The ‘Tax on Tax’ impact is the best way to define the cascading tax effect. The unified taxation system also makes it easier for both the government and the vendors to collect taxes. They also simplify the process of determining an item’s tax rate.

2. Increased Threshold for Registration

Previously, every company with a turnover of more than Rs 5 lakh (in most states) was required to pay VAT. Please keep in mind that this restriction varied per state. Service providers with a turnover of less than Rs 10 lakh are also exempt from paying service tax. This ceiling has been raised to Rs 20 lakh under the GST regime, which exempts many small businesses and service providers.

3. Logistics Efficiency Has Improved

To circumvent the present CST and state entrance fees on inter-state transportation, India’s logistics sector has to operate numerous warehouses across states. These warehouses were compelled to operate at a reduced capacity, resulting in higher operational expenses.

However, under the GST, these limits on interstate goods movement have been reduced. As a result of the GST, warehouse operators and e-commerce aggregators have expressed interest in locating their warehouses in key areas, such as Nagpur (India’s zero-mile city), rather than in every other city along their delivery route.

4. Increased GDP

It can increase the country’s gross domestic product. With increasing development in the country, the GDP value is projected to rise in the positive direction due to higher tax income and reduced tax evasion. This might enhance the country’s financial situation and increase the country’s development ratio. As a result, if the GST system is made to run properly and with a better-planned structure, the country’s GDP value would continue to rise at a constant rate.

Is It Worth Pursuing GST Certification Courses in Pune?

GST certification courses have already boosted employment prospects for graduates, finance, and tax professionals such as chartered accountants, company secretaries, retired government employees, and other qualified applicants.

It is used to improve their knowledge of the Goods and Services Tax by systematically providing specialized, up-to-date information, improving problem-solving and analytical skills to improve decision-making, and imparting skills and knowledge required for self-employment and industry employment.

Pursuing GST certification courses will help you make 15% to 25% more money. Individuals will have more work opportunities as a result of it. It might be used by people to start their own consulting business. GST certification courses in Pune may help professionals in the fields of taxation, finance, and accounting improve their abilities.

Who Can Opt for GST Certification Courses in Pune?

The following is a list of individuals who will benefit from doing the GST certification courses in Pune.

- Chartered Accountants, Certified management accountants, company secretaries, and law students, among others.

- Professionals transitioning from finance to taxes.

- Finance experts who want to satisfy their tax-related professional standards.

More significantly, they must be Indian citizens. They should be in good mental health. A person who attends GST certification courses in Pune should not be considered bankrupt. They should not be convicted of a crime that carries a sentence of two years or more in jail.

Top GST Certification Courses in Pune

To assist you and further your career in this fast-developing sector, we’ve compiled a list of the best GST Certification Courses in Pune.

1. IIM Skills

IIM Skills is a top-rated online education company that offers great courses in web writing, digital and marketing, CAT training, GST, and Business Accounting and Taxation Courses in Pune, among other areas. IIM Skills offers one of the most comprehensive GST courses in Pune, allowing a newbie to become a GST expert. The course is interactive and offers immersive learning opportunities. They work to unlock the latent potential of those who are interested in money and economics. The GST Courses in Mumbai and other cities is also amongst the top professional courses provided by IIM SKILLS. Professional courses also include financial modeling courses in Pune, and digital marketing courses that IIM SKILLS conducts.

IIM Skills has put together a specialized team of specialists who have conducted extensive studies. As a consequence, they’ve devised a well-thought-out methodology for mastering the GST Act’s fundamental and advanced principles.

The course includes free e-books, software tools, and apps, as well as enough hands-on, practice to help students understand the subtleties of GST. The Online GST Course covers everything from the origins of GST to computing GST while keeping in mind the many laws, rules, and regulations. After completing the course, it will open up a world of possibilities for you to explore.

After finishing the course, candidates will get a GST Practitioner Master Certification. You will have virtual interactive courses, which will allow you to engage with your classmates and address any questions you may have on the spot. You may ask the mentors anything regarding GST, and they will gladly assist you.

IIM SKILLS is one of those institutes that will help you out even when the course is completed. You not only have free lifetime access to their learning management system but can easily avail of their support desk for doubts and query resolution. They have partnered up with several corporate organizations to offer internships and placement support. Due to these features, they are considered to be one of the top GST Certification Courses in Pune and India.

Highlights of IIM Skills

- Fundamentals of GST

- Advantages of GST

- Understanding TDS and TCS

- Reverse Charge Mechanism

- GST Composition Scheme

- Credit and Debit Notes

- Auditing and Assessment

- GST Refund

- GST law

- Time, Place, and Value of supply

- Surrender of GST

Course Fee: Rs 9900 + GST

This form is currently undergoing maintenance. Please try again later.

IIM Skills Brand Partners

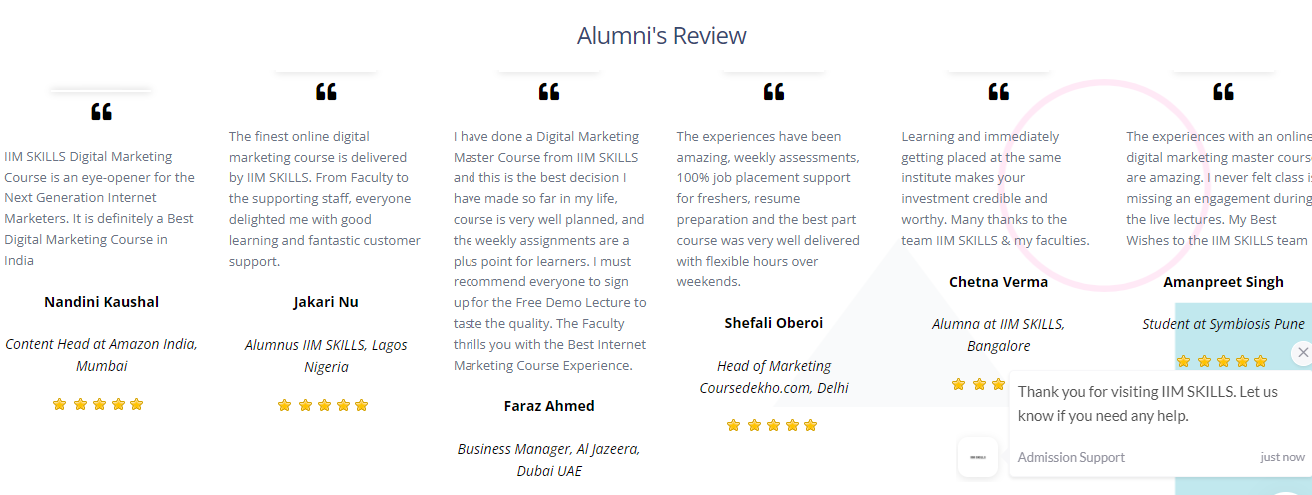

Reviews and Testimonials

Phone: 99118369503

Email: info@iimskills.com

Job-Oriented courses at IIM SKILLS

Business Accounting And Taxation Course

2. RD’s Institute of Accounts & Taxation

The institute, which is headquartered in Pune and was launched on July 4, 2017, is one of the first institutes to give practical training and needed skills for GST certification courses in Pune. It is developed and operated by a group of chartered accountants who have been practicing for the past ten years and are highly enthusiastic, active, and talented.

The Institute of Accounts and Taxation at RD provides professional courses in accounting, finance, and taxation. Through real-life corporate initiatives, they teach expertise ranging from the fundamentals to advanced levels. Experienced chartered accountants, corporate secretaries, legal experts, and IT professionals make up their faculty.

They provide GST training that includes practice projects and study materials. They also provide free GST return filing practice software to students. This program may be used for both practicing and submitting taxes.

Highlights:

- Present Taxation Systems vs. GST concept

- Impact of GST

- Registration Process

- The SGST, CGST, UTGST, and IGST concepts

- GST collection

- GST Structure of the Rates

- Location of Goods and Services Supply

- Value of Supply, Taxation Point

- GST’s Input Credit Mechanism

- Accounting Entries with Project Work SGST, CGST, UTGST, and IGST Calculation

- GSTR preparation and filing

- Tax Refund for Payment of Goods and Services Tax

Find out more about the best GST Courses In India from our list here.

3. Hope Career Academy

It is a TEACH-accredited training facility run by India’s National Skill Development Division. It is an ISO 9001: 2015 certified center and a GST Center franchisee. HR generalist training, professional business accounting, digital marketing training, SAP, and even GST courses in Pune are just a few of the job-oriented courses offered at Hope Career Academy.

Hope Career Academy also offers training in areas such as bank exam tutorials, soft skills training, personality development, team building, and stress management. In just over four years, the school has developed a wide range of courses to educate students and professionals in a variety of fields. The academy also provides career advice at the school level.

Highlight:

- Beginner’s Course – The 15 beginner’s courses cover everything from an overview through valuation, payment, job work, IGST, and accessing the GST site. Each module concludes with an exam.

- Intermediate Course – Registration, e-way bill, returns, refunds, violations, and fines are all covered in the Intermediate Course’s 12 modules.

- Returns – GSTR-3B, GSTR-1, GSTR-2A, and GSTR-2 are the GST returns that cover exactly that issue.

- GST on Tally – Tally’s GST module contains nine modules, including activating GST at the corporate level, generating masters, and setting GST rates, tax ledgers, tax credits, and documenting different purchases.

- Business Management – GST business management is divided into three modules, each with several sub-modules. Basic GST principles, GST on Tally ERP 9, and GST returns are the three modules.

4. Arsim Institute

The Pune-based college was founded in 2017 and is a top performer in the area of Tally and GST Training Institutes. It is one of the top GST certification courses in Pune. This course is open to anybody who wants to learn and study GST to become a GST expert or a qualified GST practitioner.

All of the fundamental and advanced principles of GST are covered in this section. The learner will have a comprehensive grasp of GST administration and will be a GST specialist in the future. All tax/account professionals, manager accounts, CFOs, revenue officials, CAs, and other finance students would benefit from this GST certificate course. This training will take you from novice to expert in no time.

The institute offers a diverse selection of products and services, as well as fast help from friendly personnel. All of the courses are taught by chartered accountants who are experts in their field.

This is a hands-on practical training session that includes evaluations. It also provides applicants with information about the GST software. Arsim Institute provides a free copy of GST software that may be used to submit returns on your own.

Highlights:

- Overview of the GST

- Administration Levy & Tax Collection for GST Registration

- Goods and services supply

- Input Tax Credit Concepts

- Debit & Credit Notes on Invoices

- Returns on Accounts & Records

- Input Tax Credits & Refunds

5. Tech Craft

TechCraft is also a training and skill development platform that develops and distributes courses to help people advance their careers. Kate Education and Consultancy Services Pvt. Ltd. owns the brand. Classroom, online, and corporate training are all available at the institute.

The institution provides popular courses such as advanced Excel and MIS, as well as GST certification courses in Pune. It is worthwhile to enroll at Tech Craft because of its sophisticated course material, competent instructors, good teaching approach, and practical training.

Highlights:

- GST calculation, Tally ERP9 implementation.

- Returns and payments, registrations, and salary and business income tax.

- It consists of about nine modules.

6. Edupristine

Edupristine is one of the top institutes offering GST certification courses in Pune. The mode of training is classroom-based and the course helps you to understand the fundamentals of GST. All important concepts including terminology, implementation, application, impact, and enforcement are covered in the course.

The GST certification course is industry endorsed and recognized and offers additional features like study materials, resources, including advanced Excel, and a GST ebook for a better understanding of the application of GST.

It is a comprehensive 32-hour program that is meant to provide you with the knowledge that is required to get lucrative job opportunities in the finance sector as GST practitioners.

Course structure

- Fundamentals Of Taxation System

- Introduction To The GST

- Structure, Comparison Of Rates

- Time And Place Of Supply

- Tax Invoice

- Application Of GST

- Input Tax Credit

- Composition Scheme

- GST Returns

- Return Filing

- MIS

- Compliances

- GST Accounting

- Role Of Tally In GST

- Difference Between Indirect Tax And GST

- Payment Of Taxes Valuation Among Others.

Undergraduates, MBA graduates, working professionals, tax consultants, students, freshers, and people interested in a career in finance, accounting, and taxation will benefit greatly from the course.

It requires you to have an analytical mind with an inclination towards mathematics. Knowledge of accounting and taxation is preferred though not mandatory.

They also have online support that is available to you 24/7. Additionally, you get access to course materials that include presentations, practical projects for practice, utility files, recordings, case studies, and resources

Contact – 1800 2005 835, 8828322444

7. ACTE

ACTE is one of the most illustrious institutes offering GST certification courses in Pune. They offer online training as well as physical classroom training and have partnered with several IT companies. They offer coaching and professional programs to students and working professionals for them to become more efficient.

The programs are designed in collaboration with several industry experts which is why they are one of the most renowned institutes for IT training.

The GST certification training in Pune at ACTE is an online training led by experts of the financial domain in a live classroom setup.

The course comprises advanced as well as fundamental concepts. Hence, it is ideal for beginners as well as people who have some experience of working in the finance and accounting sector.

You have several hands-on training projects in GST and incorporate the best practices to become astute GST practitioners.

One of the distinctive features of the institute is that they provide lifetime access to the students portal that includes study materials, videos, presentations, interview questions, and answers from top MNCs. They also offer soft skills training to crack interviews at multinational corporations.

The mentors have more than 9 years of experience in the financial sector and are GST certified experts.

The 40 + hours of hands-on training includes more than 25 practical assignments and 3 + live projects for a more exhaustive understanding of GST.

It is a job-oriented, industry-validated curriculum that prepares you for real projects. You cal also avail of demo class to understand whether the GST course is suited to you.

Curriculum

- Manual Accounting Basics

- Voucher Preparation

- Stock Valuation

- Finalization Of Accounts

- Accounting Using Tally

- Features Of GST

- Banking Fundamentals And Advanced Concepts

- Multiple Taxes And Cascading

- GST Compliance & Procedures

- GST Components

- Tax Structure In GST

- Advantages Of GST

- GST Registration

- Filing GST Returns

- Input Tax Credit

- Gst Invoices

- Mis Reports

- Advanced Excel.

Contact 90927 99991, 93800 99996

Frequently Asked Questions:

Q1. How much does it cost to pursue a GST certification course in Pune?

Depending on the course level, the cost of the GST certification course in Pune might range from INR 3000 to INR 55000 approximately.

Q2. What are the requirements for a career as a GST practitioner?

Any recognized Indian University that is allowed by law requires a graduate or postgraduate degree in commerce, law, banking, business administration, or business management, or an equivalent degree in commerce, law, banking, business administration, or business management. If you meet these requirements, you may apply for the GST practitioner test by filling out form GST PCT – 01 and submitting it through the GST common portal.

Q3. How much does a certified GST practitioner in India earn on average?

In India, the typical yearly pay for a GST practitioner accounts manager is INR 4.9–6.4 lakhs.

Q4. Is studying GST certification courses in Pune lead to a successful profession?

It can assist to increase an individual’s pay by 15% to 25% on average. Individuals will have more work options as a result of this. Individuals might use it to create their consulting firm. It aids in the development of various tax, finance, and accounting professionals’ abilities.

Conclusion

To summarise, the course certificate is a more valuable value-added certification course for both tax professionals and anyone seeking to improve their understanding of the indirect tax system. The implementation of the GST simplifies the indirect tax system, which is another benefit of the GST certificate. The GST system covers the vast majority of the indirect tax system, and the GST course covers all of it.

The GST certificate is more useful than previously because of the added benefit of employability through the certification course and the business prospects accessible following the course certification. Because of the online manner of delivery, it is also a suitable certification for working professionals.

To summarise, the Goods and Service Tax certification course is worthwhile and provides additional benefits. The certification course in the tax industry is unquestionably larger and essential, as it provides a fuller picture of the country’s indirect tax structure.