The Goods and Services Tax (GST), popularly quoted as, ‘One Nation, One Tax’ came into effect on the 1st of July 2017. It is laid by the Indian GST council as an indirect tax, imposed on a taxpayer for the various goods and services rendered.

After its inception, many other taxes got replaced by this one single tax. Nagpur zone shares a commendable GST revenue to the nations’ highest taxpayer state, Maharashtra. Here, the ‘best 8 GST certification courses in Nagpur’ helpful in building a solid knowledge of various GST regulations are discussed.

First, let’s discuss before proceeding with the best GST certification courses in Nagpur.

Who Are The GST Payers? And What Are The Benefits Doing So?

GST is a tax levied on goods and services at every point of its supply chain to individuals and business units who cross a threshold turnover limit more than the prescribed limit set by the government.

Ever since its introduction, the cascading, tax on tax effect has been curbed along with the reduced cost of goods and easy access to online filings and returns.

Now Let’s Discuss The Benefits:-

- It brings higher efficiency in logistics.

- Provides comprehensiveness to the Nation’s tax policies and ease of financial dealings.

- Regulates a well-defined tax structure to e-commerce activities.

- Decreases the cost of compliance to firms and companies.

- New ventures of people like startups, companies are well-supported by the new GST regime.

- Lucid composition scheme to small business activities with minimum turnovers.

- Assures a salary hike of 15 % to 25 % on average to employees of India.

What Are The Parts of GST?

The tax structure of GST is divided into three parts. They are:-

CGST – Central Goods and Services Tax – The central government collects this intra-state tax.

SGST – State Goods and Services Tax – The state government collects this intra-state tax.

IGST – Integrated Goods and Services Tax – Central government tax collected for

inter-state (between one state to another state) sales activities.

You can also check the 10 Best GST Certification Courses in India

Why Certification Course is Essential?

The GST certification course is an essential course to support professionals like Chartered Accountants(CA), Company Secretaries(CS), businessmen, entrepreneurs, tax lawyers, people carrying out GST filing for others as their full or part-time careers, etc.

It provides updated knowledge on the new taxation structure that improves crucial problem-solving and analytical skills needed for the individual’s self-improvement and to build a strong root to the Indian economy too.

With a value-added certification, one can clearly understand the budget amendments and other financial dealings allocated on every fiscal year. It covers a wide range of concepts structured by the Indian government around the below-mentioned categories:-

- GST Registration

- GST Levy

- GST Customs Duty

- GST Returns

- GST Valuation

- GST Time and Place of Supply

- GST Advance Ruling

- Input Tax Credit

- GST Ethical Practices

- Tax Litigation etc.

To gain a good knowledge of GST, this guide will be helpful for readers.

The Best 8 Gst Certification Courses in Nagpur Are Detailed As Follows:-

1. IIM Skills – GST Certification Course

IIM Skills offers rich, all-inclusive, well-oriented GST practitioner coaching for candidates enrolled in their Master GST practitioner certification course. It pioneers as number one among the best GST certification courses in Nagpur. It provides practical training for candidates. The course is taught by industry experts and lead CA faculty, Priyanka Aggarwal. The subjects taught are categorized into 9 lucid modules. IIM SKILLS offers GST courses in Mumbai, and various other cities as well.

They Are:-

- Module 1 – Is structured on the genesis and concept of GST.

- Module 2 – Registration process under GST.

- Module 3 – elaborates on the framework and structure of GST.

- Module 4 – Invoicing rules and regulations

- Module 5 – Input tax and credit payment in GST.

- Module 6 – GST returns filling

- Module 7 – Composition scheme under GST.

- Module 8 – Reverse charge mechanism (RCM).

- Module 9 – E-way bill under the GST Reform.

Core Features of The Course:-

- The online GST course is taught by industry people and subject matter experts like chartered a

- The virtual classes are organized via the Zoom app.

- There is an anytime, anywhere lifetime accessing option to recorded tutorials via their Learning Management System (LMS).

- They are toppers in this field since their relevancy of course meets the current industry standards. There are multiple batches available.

- The course is budget-friendly and is coming at Rs. 2900

To get a better knowledge of various GST-related insightful information, this GST blog from IIM skills will be very helpful.

Once the course is finished with 16+ hours of lecture from 10 am to 2 pm, every Sunday and with extra classes on some other days, there will be an online test conducted to the candidates for issuing the course completion certification from IIM Skills.

Brand Partners in Collaboration with IIM SKILLS for Placement

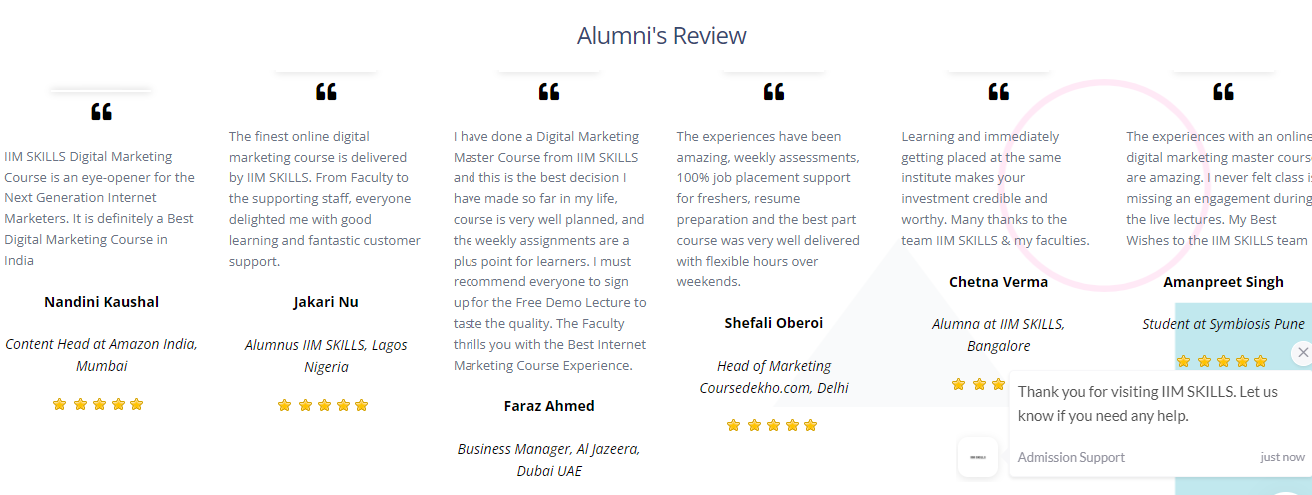

Testimonials And Reviews

Why Should You Choose IIM SKILLS For GST Certification Course?

- The course curriculum has been designed in a manner that helps you to glean knowledge about GST no matter when you start. So whether you are a student or a job aspirant, a professional in the domain of accounting and taxation, a business owner or lawyer, you will benefit from the course.

- IIM SKILLS offers weekly assessments in practical assignments that will push the envelope and help you become confident in carrying out GST-related work.

- You will gain an in-depth understanding of the structure, implementation, execution, and enforcement of GST after completion of this course.

- For a business owner, it can be extremely beneficial to reconsider and conceptualize your pricing strategies in compliance with the GST structure.

- All GST provisions are covered in detail in the course which helps you to become job-oriented and skilled with an understanding of finance in-depth.

- The curriculum is updated regularly implementing all the latest changes in the GST domain. The hands-on training and assignments training are under the guidance of mentors who are experts in the GST field and have had a very lucrative career in this domain.

- The course fee includes your exam and certification fee. This meticulously designed program has been made for the purpose of providing you with incisive education on GST. When new changes are implemented, there is bound to be ambiguity surrounding the change. The IIM SKILLS GST certificate course aims to eliminate such ambiguity and confusion and help you become more adept at handling GST and becoming a more able professional. Furthermore,, the live query resolution feature of the institute helps you to resolve your queries in doubts there, and then that’s providing with prompt support. These features make IIM SKILLS one f the best GST Certification Courses in Nagpur

Course Fee – INR 9900 (Including GST)

This form is currently undergoing maintenance. Please try again later.

Check out these other courses from IIM SKILLS

Business Accounting And Taxation Course

2. TaxGuru – GST Certification Course

TaxGuru’s GST certification course comes second among the best 8 GST certification courses in Nagpur. It is well-structured and well-taught by TaxGuru’s educational wing TaxGuru Edu. This professional development course supports professionals working on finance-related jobs. The tutor for this course is CA Raman Singla. Here in this institute, they have categorized the course in sessions accordingly.

They Are:-

- Session 1 – Around constitution; aspects and basic concepts of GST.

- Session 2 – Around taxes subsumed on GST and various GST set off rules.

- Session 3 – Regarding GSTR-3B, GSTR-1, GST return filing, reversal on an exempt and taxable supply, etc.

- Session 4 – Brief on registration, supply to SEZ, and so on.

- Session 5 – Classes are around levy and collection, TDS, TCS.

- Session 6 – Organized especially for the input tax credit

- Session 7 – On reverse charge mechanism, time of supply, GST on advances, etc.

- Session 8 – On the place of supply, a bill to ship to, cross-charge, and so on.

- Session 9 – Transitional scheme, assessment, complete coverage of GST laws, etc.

Core Features of The Course:-

- Online course on updated law with live query resolution.

- Reading materials issued in e-form

- Course completion certificate after the successful completion of course by TaxGuru Edu.

- Weekend batches on Saturdays and Sundays for around 30 hours.

- Recordings of classes offered to candidates for a limited period.

- The course is coming for a pocket-friendly budget of Rs. 10,000/- + GST.

3. NIFM, Nagpur – Certified GST Professional

National Institute of Finance Markets (NIFM) is famous for its short-term, diploma programs in skill development. It has branches in Nagpur and other parts of India too. It offers many finance-related courses in both online and classroom-based tutorials. Its certified GST professional course is one of the best 8 GST certification courses in Nagpur and is taught by experts with 10 years + knowledge in the finance field. The smart, classroom-based certification course is organized into modules. They include:

- Module 1 – Introduction of Goods and Services Tax.

- Module 2 – Structure of GST.

- Module 3 – Invoicing in GST.

- Module 4 – Input Tax Credit & Payment in GST.

- Module 5 – GST Return Filing.

- Module 6 – Composition Scheme Under GST.

- Module 7 – Reverse Charge Mechanism.

- Module 8 – Registration Under GST.

The course provides 360-degree insights on various GST-related information.

Core Features of The Course:-

- Curriculum-based on 80 % practical training and 20 % theoretical training.

- In-depth information on GST laws, applications, and concepts.

- 2 months of classroom-based training.

- Availability of weekend batches.

- Professional GST certifications

- E-filling of GST forms with automation of periodical filling.

- Get support from the institute to work as a freelancer.

- The course fee comes around Rs.25,000/- + GST.

The course is mostly preferred by finance professionals, analysts, freelance accountants, and business owners. It provides updated knowledge on new software too.

There are several courses among which financial modeling courses in Nagpur are very popular and sought-after due to the lucrative job offers.

4. ClearTax & Udemy – Complete GST Course & Certification-Grow Your CA Practice

This GST course out of the best GST certification courses in Nagpur is offered by ClearTax on the Udemy learning platform. ClearTax is a 12-year-old company specializing in Tax domain. They are offering courses in GST under the names of Complete GST Course & Certification-Grow Your CA Practice and New GST E-Learning Certification by ClearTax on the Udemy online learning platform. It is so helpful and provides a comprehensive idea of GST filings and returns.

The tutors are CA Preeti Khurana, who has 15+ years of expertise in taxation, serving as a chief editor in ClearTax company, and CA Surbhi Punshi, who is an Indirect tax expert professional at ClearTax. The course is divided into sections.

They Are:-

- Basics of GST ( Video lectures on one section and articles on one section ).

- Composition Scheme ( Video lectures on one section and articles on one section ).

- Input Tax Credit ( Video lectures on one section and articles on one section ).

- GST Registration ( Video lectures on one section and articles on one section ).

- Transitional Provisions.

- Time of Supply, Place of Supply, and Value of Supply in respective sections.

- GST by Ashok Batra.

- Offenses and Penalties.

- New Council Meeting: GST Rates.

- Impact on Trading Sector.

Core Features of The Course:-

- It has 42 hours of on-demand video.

- It has 29 articles.

- Lifetime access to the study materials.

- Certificate of completion by Udemy and ClearTax.

- The course comes for a package of INR 4800/-.

- The course is taught in the Hindi language also.

5. MSME – GST Certification Courses in Nagpur

The ministry of MSME (Micro, Small, and Medium Enterprises), offers certifications under names like GST Certification Course, GST Practitioner Advanced Certified Training, and so on. These government-approved courses are very helpful for professionals in the taxation domain, law aspirants, chartered accountants and graduates in many other fields. MSME stands as the fifth topper among the best GST certification courses in Nagpur. The course is taught in the following categories in a few centers collaborated with MSME.

- GST Introduction.

- Tax Rates Under GST.

- Various Tab Before GST.

- GST Registration.

- SGST and IGST Invoicing Under GST.

- GST Forms: GSTR1, GSTR2, GSTR3, GSTR4, and Annual Return.

- GST Return Filing.

- Introduction of GST.

- Filling: GSTR9, E-Way Bill Under GST, GST-TCS, GST-TDS, GST-Practitioner Registration.

- GST Related Refund Process, GST Accounts, and Records Maintenance.

- Debit-Credit Under GST.

- GST Practitioner Exam Preparation.

Core Features of The Course:-

- Classroom-based training ( happening usually ) and online training( happening after the pandemic ).

- The government of India approved certification.

- The fee comes around Rs. 7500/- (including GST). For transactions like NEFT, UPI, etc. A 5% discount can be availed on the GST applicable to the course fee. Few MSME collaborated centers offer courses with pricing around Rs. 5,900/- (including GST).

- MSME is arranging boarding and lodging facilities along with reading materials for students coming from remote places.

- This offline method of learning happens from morning 9:30 am to evening 5:30 pm.

It is a three to four days class that happens as a campaign kind of skill-building program, that is, for eg. at Nagpur, the MSME development institute is situated. Similarly, in other places of the country, either MSME centers or any private locations are considered for course campaigns to happen around.

The candidates shall have a check on the campaign programs of the government on MSME or other private websites to know the venue details, availability of seats, offline or online method of coaching availabilities, etc.

The government institutes like Central Footwear Institute(CFTI), Chennai, National Institute for Micro, Small and Medium Enterprises (NI-MSME), Hyderabad are also conducting GST training programs by joining hands with MSME. After the pandemic, centers like CFTI are conducting online courses via the Zoom app at least once in a time around 1-2 months frame. This is accessible remotely from many parts of the country also.

6. ISEL Global – GST Practitioner Certification Course

The International Society for Executive Learning (ISEL) offers a 3 month GST practitioner online course. It provides a comprehensive, seamless guide to the GST regulations. It is one of the best GST certification courses in Nagpur. The course advisor for this certification program is CA Saurabh D.Jog. It is suited to any kind of professionals to gain knowledge on the taxation terminologies and the benefits. The course is designed around the below 10 modules:-

- Module 1 – Taxation and GST Basics.

- Module 2 – GST Concepts and Basics.

- Module 3 – GST Registration.

- Module 4 – GST Invoicing.

- Module 5 – GST Returns.

- Module 6 – Input Tax Credit.

- Module 7 – GST Valuation.

- Module 8 – GST Legal Provisions.

- Module 9 – Miscellaneous.

- Module 10 – GST Practitioner Certification Examination.

Core Features of The Course:-

- Online training with high-quality e-learning content for around 35+ hours.

- Live interactive online Q&A sessions with GST f

- GST study notes, Excel offline tool.

- Government of India MSME certification after successful completion of online examination.

- Faculties with 25 + years of expertise in the field.

- Technical support via e-mail.

- Course fee comes around for Rs. 7600/- + GST.

7. ICAI – Certificate Course on GST

The Institute of Chartered Accountants of India (ICAI) ranks seventh among the best GST certification courses in Nagpur and it offers 10 days weekend classes on GST certification courses in some of the cities in India including Nagpur. This course is designed to provide the members, an avenue in the global service market and enhance them with analytical and problem-solving skills. The faculties are practicing CA’s, experts, and academicians. The course subjects are covered in sessions and will cover the below topics:-

- Definition and Concept under GST.

- Time of Supply.

- Place of Supply.

- Input Tax Credit.

- Transitional Issues.

- Registration, Returns, Payment, and Refund.

- Assessment, Offenses, Penalties, Advance Ruling, FTP.

- Customs Duty.

- Ethical Practice.

- Details on Overview of GST-Compensation cess to States Act. 2017.

- Exemption List of Goods and Services.

- Miscellaneous Provision.

This course is designed only for the members of ICAI who are CA’s. The course can be undertaken on weekdays for 2 weeks also.

Core Features of The Course:-

- A free quick e-referencer background material on GST law for commerce students is provided.

- ICAI’s course completion certificate is given after completing two assessment tests happening in a year.

- After the course completion, the CPE hours are structured for 25 hours and after attending the assessment test, CPE hours are structured for 5 hours.

- The cost of the course is coming around Rs. 14,000/- + GST for big cities like Delhi, Mumbai, Chennai, Kolkata, Pune, Hyderabad, Bengaluru, Ahmedabad, and Jaipur, and for other cities the pricing is Rs. 12,600/-.

8. GST Center – Diploma in GST and GST in Business Management

GST Centre is one of the best GST certification courses in Nagpur that offers a Diploma in GST, GST in business management, and certified GST professional (GST practitioner). GST Centre is an initiative of the ‘Teach’ group and is started in the year 2015 by CA Naison Louis. They provide both online and offline classes. Also, they conduct regular workshops in different cities. They provide offline materials for reading along with supportive software. Courses are designed for beginners and intermediate learners also. The GST Beginners’ course comprises the following topics:-

- Overview of Goods and Services Tax

- Levy and Collection of Tax

- Registrations For Various Persons

- Procedure For Registration

- Time of Supply

- Value of Supply

- Tax Rates and Classifications

- Input Tax Credit

- Tax Invoice, Credit Debit Notes

- Accounts and Records

- Payment of GST

- E-Way Bill

Core Features of The Course:-

- It has Learning Management System for recorded tutorials.

- Provides hands-on experience on simulation software like Sahaj, Sugam, and Normal Return.

- Certification is approved by the Ministry of Skill Development and Entrepreneurship, Govt. of India.

- Provides internship opportunities and skill-oriented software.

- Freelance accounting program opportunities.

- Live Q & A sessions for doubt clarifications.

- The course fees come around Rs.12,000/- + GST.

Some Points to note about the courses on GST

- Most of the centers provide offline and online courses on GST on around 3 days 3 months basis.

- LMS tutorials are very helpful for students to have a look at the recordings for the future.

- Tutors are well-qualified CA’s and academicians who support well on queries, course benefits, and job assistance.

Frequently Asked Questions on GST Certification Courses

1. Does ICAI offer a GST certification course for non-members?

No, ICAI offers GST Certification Course only for the members. Non-members are not selected for the course.

2. What are the GST-related courses offered by the government?

The courses offered by MSME and other centers adjoining with MSME provide government-approved certificate programs.

3. What is the scope for GST practitioners in the job sector?

Professionals after completing the GST Practitioner course can be a Taxation Manager, Taxation Research Analyst, can do GST Compliance, Consultation, and Legal Practice.

4. What is the fee structure of GST Courses in India?

The fee structure ranges from INR. 3000/- to around INR 25,000/-.

Conclusion

Thus, these are the best 8 GST certification courses in Nagpur that are structured around the new GST regime. These courses are all meant to provide a rigorous understanding of GST. However, all institutes have some unique characteristics. Research well and enroll in a GST course that meets most or all of your expectations. practical assignments, access to LMS for an extended period are key features to look for in an institute with a GST course.