India is currently undergoing the world’s most significant tax revolution due to implementing the Goods and Services Tax in 2017. The novel tax structure impacted the nation because it combined all the different kinds of taxes that were previously levied on the acquisition and sale of products and services into a single tax. This article will provide information about the top four institutes that provide GST certification courses in Gurgaon. But, first, let’s take a closer look at GST and the basic requirements for enrolling in a GST certification course in Gurgaon.

What is the Goods and Services Tax and its Implications for Businesses?

- The word GST implies “Goods and Administrations Tax.” It is proposed as an all-inclusive indirect tax imposed on fabrication, trading, and utilization of merchandise and services at the national level.

- Its primary objective is to integrate all indirect tax excise collected into a single tax, excluding customs (barring SAD), supplanting numerous tax demands, overcoming the confinements of the existing indirect tax framework, and regulating tax administration.

- Goods and Services Tax (GST) is critical to amend indirect tax collection in India. Merging a substantial number of Central and State taxes into one tax would ease the surge or twofold tax collection hugely and make way for a common national market.

- From the consumer’s perspective, the most significant advantage would be a decrease in the general tax burden on products, now evaluated at 16%-18%.

- The revised tax slabs are 5%, 12%, 18%, and 28% and are divided into four categories: CGST (Central GST), SGST (State GST), IGST (Integrated GST), and UGST (Union GST). There are also exceptions, like electricity, alcoholic beverages, and petroleum products, which are individual taxes that state governments tax.

- The implementation of GST would also make Indian products more competitive in domestic and global markets. According to studies, this would immediately boost economic growth. Lastly, because of its public accountability, this tax would be easier to administer.

Learn and understand How GST Works in a simplified manner

The Demand for GST Certification Courses in Gurgaon

This amended tax rule needs to be understood by the taxpayers and businesses for it to be successful. Taxpayers must be educated on the benefits of the new tax system and be GST compliant to check system changes in real-time. Depending on the operating geographies, size, and sector, the changes would be significant and necessitate strategic planning with a time-bound action plan. Companies are also expected to learn about GST development initiatives, their ramifications for strategy development, and transition framework preparation to be ready for GST implementation.

Hence, this new framework is increasing the demand for professional tax consultants who are well-versed in GST. To meet these business requirements, companies are now looking at hiring an expert to evaluate and process GST or improve the GST capabilities of their existing resources by sending their staff to learn GST in hopes of avoiding the expensive and time-consuming process of hiring.

Due to the needs mentioned above, many training institutes have sprouted offering industry-specific GST Certification Courses in Gurgaon. They aim to provide learners with relevant, job-oriented lectures and practical training on GST concepts to gain proficiency in the new taxation policy.

For more details, please read Basic Concepts of GST Explained

Who is Eligible to Join A GST Course?

The following individuals can avail of these hugely rewarding GST certification courses in Gurgaon:

- Students who have recently completed their BA and MA degrees in Commerce, Economics, Finance, or Statistics, CAs, CMAs, CSS, and those aspiring to be lawyers.

- Salaried professionals who have a primary degree and want to take up a career in taxation.

- Employees who want to switch careers from finance to taxation.

- Financial managers and e-accountants who need to carry out GST compliance for their organizations.

- Individuals who need to teach GST as a subject in educational institutions.

- Individuals who have recently taken up the role of GST practitioner.

What Are The Topics Covered in the GST Certification Courses in Gurgaon?

The Goods and Services Tax (GST) course should cover all relevant GST topics, such as:

- GST registration and migration

- GST returns and reimbursements

- Input tax credit

- GST E-commerce

- GST job work and composition levy

- GST laws and guidelines

- GST penalties

- GST ethical practice

- Model IGST law

4 Best GST Certification Courses in Gurgaon

# 1 IIM Skills- GST Course

IIM Skills, a leading training establishment, provides four weeks of live online GST certificate program that includes practical assignments, complimentary e-books, and invoice processing tools and software. It is one of the most sought-after GST certification courses in Gurgaon. This course will provide you with a good understanding of the Goods and Services Tax (GST), including its origins, regulatory standards, implementation methods, and enforcement mechanisms. This course focuses on teaching the intricacies of how GST works with relevant case studies and course material that reflect current trends.

Another salient feature is the online exam conducted at the course’s conclusion, which is mandatory to gain your certificate. Along with the certificate, you will also gain lifetime access to the sessions, career mentoring, and round-the-clock support from the faculty and GST specialists. All of this will make you employment-ready, having gained an in-depth understanding of how GST works and other GST processes, such as registration, TDS compliance, tax filings, and reimbursements.

IIM SKILLS offers a variety of other courses like content writing courses in India, digital marketing courses, and other professional courses including one of the best financial modeling courses in Gurgaon.

Course Curriculum

- Concept of GST-Origin, Types, and Impact

- Overall Framework and Valuation

- Process of GST Registration

- Invoicing Rules and Regulations

- GST Returns and Reconciliation

- Regulation and Limitations of Composition Scheme

- What are RCM (Reverse Charge Mechanism) and E-Way Bill?

- Input Tax Credit System

Brand Partners

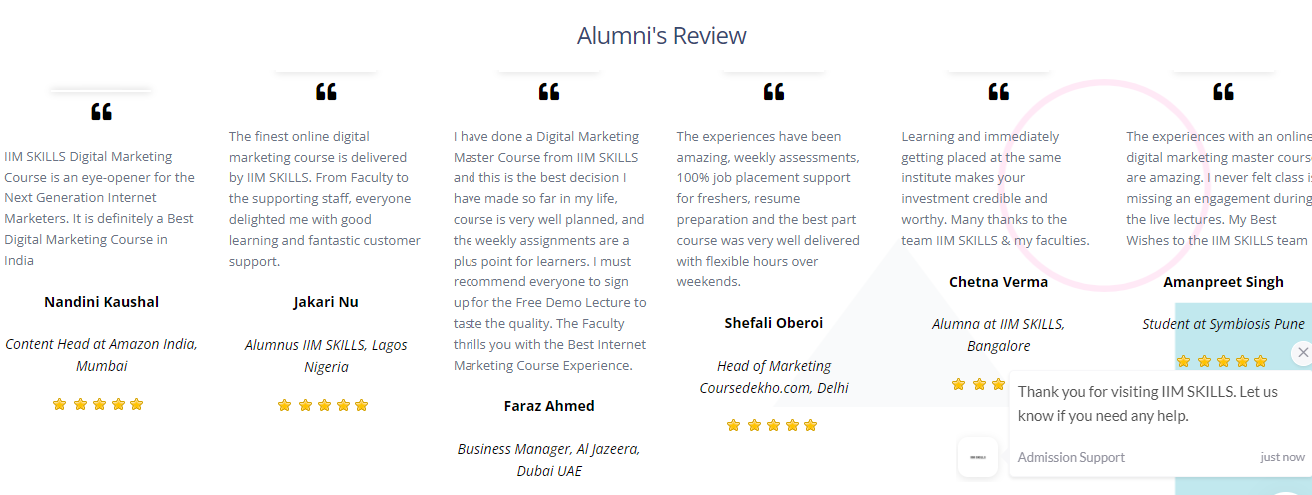

Testimonials

Why Enroll in IIM SKILLS GST Certification Course in Gurgaon?

1. An In-depth Course Curriculum

2. A Thorough Registration Process

3. Lifetime Validity to LMS

4. A Prompt Support Desk For Query Resolution

Course Fees:

INR 9900 + GST

This form is currently undergoing maintenance. Please try again later.

Batch Timings:

Sunday-10 am to 2 pm (IST)

Tuesday and Thursday (invitation only)-8 pm to 10 pm (IST)

Contact Details:

Phone no. : +91 9911839503

Email: info@iimskills.com

Check out these other courses from IIM SKILLS

Business Accounting And Taxation Course

# 2: The Institute of Chartered Accountants of India (ICAI)-GST Certification Course

It was created by the Indian government and served as one of the leading institutes that provide GST certification courses in Gurgaon. The classroom training model provides specialized and up-to-date GST concepts and expertise organized by industry experts chartered accountants and experienced GST practitioners. It also enhances analytical and problem-solving abilities, enabling more informed decision-making. On completion of the course, participants need to undergo an assessment to gain their certification.

Course Curriculum:

- Overview of GST – Definitions and Concepts

- Taxes: Purpose and Levy of Taxes

- Introduction to the Purpose of Time of Supply and Place of Supply

- What is the Input Tax Credit?

- Transitional Issues

- Understanding Valuation, Registration, Returns, Payment, Reimbursements

- Guidelines on Offences, Penalties, and Advance Ruling

- The framework of Foreign Trade Policies and Customs Duty

- Services/Products Exempted from GST

- Ethical Practices

- Miscellaneous Provisions

Eligibility for Joining the Course

Participants who have enrolled for the ICAI’s CA exam or course are the only ones who are eligible to register for their GST course. The course assumes that participants have a fundamental knowledge of the subject and the skills required for working in the international corporate world. Following course completion, ICAI provides video recordings of the learning content.

If you are not a member of ICAI, you can still opt for the free e-learning GST course conducted by ICAI. Although you will not receive a certificate, the topics covered are similar to their certification course and come with a soft copy of the study material.

Course Fees: (10-day course)

- Delhi, Mumbai, Chennai, Kolkata, Hyderabad, Bangalore, Pune, Ahmedabad, and Jaipur – INR 14,000 + GST

- All other cities – INR 12,600

Batch Timings:

Saturday and Sunday-9:30 am to 5:30 pm

Monday to Friday-9:30 am to 5:30 pm

Contact Details:

Phone no: +91 1203045954

Email: gst@icai.in

Check out our list of the best online and offline GST Certification courses in Pune

# 3: Institute of Company Secretaries of India-ICSI-GST Certification Course

Apart from the ICAI, the Indian government formed the ICSI, or the Indian Institute of Company Secretaries (ICSI is a professional body created to develop and regulate the Company Secretaries profession in India.)

The ICSI was established under the Indian Parliament Act and the Company Secretaries Act, 1980, to deliver high-quality GST certification courses in Gurgaon. Additionally, it provides high-quality education for Company Secretaries (CS). It is affiliated with the Indian government’s Ministry of Corporate Affairs and is headquartered in New Delhi. In addition, ICIS has four regional offices located in Kolkata, New Delhi, Mumbai, and Chennai, respectively.

The ICSI GST course helps students comprehend the GST regulations and implementation and stay informed about recent GST developments. After completing the course, CS students can pursue various careers in the taxation industry. The certificate awarded after assessment will be issued jointly by ICSI and BSE Institute Limited.

Course Curriculum:

The subjects covered include the origin of GST and its evolution since inception, the laws and regulations, types of taxation and exceptions, transition issues and how to handle them, and the various processes of registering, filing, returns, refunds, and appeals.

Eligibility for Joining the Course:

Only members of ICIS and students pursuing their CS program are eligible to join.

Batch Timings:

Saturday and Sunday

Course Fees: (60-Hrs. course)

INR 7500 + GST

Contact Details:

Phone No.: 011-4534 1000

Email: info@icsi.edu

Recommended Read: Digital Marketing Courses In Pune

# 4: Institute of Cost and Works Accountants of India (ICWAI)-GST Certification Course

The Institute of Cost & Works Accountants of India (ICWAI) is India’s third-largest statutory professional accounting body, with the mission of promoting, regulating, and developing the practice of cost and management accounting. ICWAI was founded in 1944 as a registered company under the Companies Act.

In 1959, the ICWAI was placed under the purview of a special act of Parliament. Since then, the academy has made significant contributions to India’s industrial and economic development. It is believed to be India’s third-best government-trusted institute, offering GST certification courses in Gurgaon after ICAI and ICSI.

Course Curriculum:

- Background of GST

- GST Concepts and Definitions

- Understanding Classification, HSN, SAC

- Rules of Input Tax Credit and Refund of ITC

- Maintaining Records and Filing Returns

- How to Make Payment and the Rules for Refunds

- Penalties and Prosecutions

- Applicability of TDS and TCS under GST

- Guidelines for Valuation under GST

- Framework for Assessment, Audit, Adjudication, and Appeal

- Advance Ruling

- Miscellaneous Provisions

Eligibility for Joining the Course:

ICWAI’S crash course is meant for college students and those pursuing a CMA. In addition, those who are members of the ICWAI institute, qualified cost & management accountants, working professionals who are CS, CA, MBA, M. Com, lawyers, and tax practitioners can opt for the certificate and advanced online courses.

Course Fees: (72-hr. course)

- Non-CMA members: INR 10,000+18% GST + Exam Fees.

- CMA members, CMA passed candidates, and CMA final pursuing students: INR 8,000 + 18% GST+ Exam Fees.

Contact Details:

Phone No.: 1800-110910/1800-3450092

Email: trd@icmai.com

Frequently Asked Questions:

Question 1: Who is eligible to take the GST training course?

Chartered accountants, auditors, income tax officials, finance managers, graduates, postgraduate students, and anyone else who wants to increase their job chances in commerce can apply for GST certification courses in Gurgaon. Once you master this skill, not only will your career prospects skyrocket, but so will your compensation.

Question 2: How is GST training beneficial?

Several benefits come with taking the GST certification course. The most important advantage is that the person’s compensation will increase by at least 15 to 25%. In addition, it will establish their credibility, provide a competitive edge, and enhance their career prospects in the field.

It will make a person self-sufficient and capable of starting and establishing their own business or consulting firm from the ground up.

As a final point, it can enable a salaried employee to learn a new skill in diverse disciplines like accounting and taxation.

Question 3. Is a degree in commerce or finance required for doing a GST course?

A background in business or finance is not required, nor is being a Chartered Accountant (CA). The only advantage is that such individuals will be able to grasp it more quickly than others, as they will be familiar with the basics of finance and accounting.

GST certification courses in Gurgaon are also available for those who already know about taxes and want to learn more about them.

Question 4: Can a person become a GST professional after completing a GST course?

You can apply for jobs or work as a consultant after completing the course and receiving your certificate. Remember to choose a suitable course from an accredited institute to add weight to your resume.

Question 5: What types of jobs can I get after completing a GST certification?

Once you have learned about the various elements relating to GST, many lucrative career options are available. Some of the trending job roles this year are taxation manager, taxation research analyst, GST compliance officer, GST practitioner, and GST trainer, to name a few.

Question 6: What are the critical skills needed for a career in GST?

Becoming familiar with GST rules and regulations is vital, but so are a few other basic skills. For example, you need to have knowledge of finance and accounting, be proficient in Microsoft Word and Excel (particularly helpful when undertaking reconciliations), develop critical thinking skills to help you comprehend the subtleties of GST, and learn how to use the GSTN portal that is used for registration, filing, returns, refunds, and appeals.

Conclusion

GST has become a central part of our everyday lives, yet many don’t understand its functions. Not only is understanding GST important for bankers and financial professionals, but the ordinary person has to understand it as well because a large percentage of their earnings is spent on taxes.

By understanding GST, we can take control of our finances and gain job opportunities as well. To find a career in this domain, it is highly recommended that job seekers undergo a certification course in GST from a well-respected institution. I recommend that you use the top four institutes listed in this post. I would recommend IIM Skills, as it satisfies all of the standard requirements for gaining a complete understanding of GST, having practical projects, and providing life-long assistance.