Goods and Services Tax or GST is a type of indirect tax merger of different taxes like sales tax, excise duty, VAT, etc. These taxes are combined into one unified tax applicable across the spectrum of goods and services. Whether you are a tycoon, a restauranteur, or a small shop owner, your business can operate if you understand and apply GST thoroughly. For that exact reason, there are many GST certificate course providers across the country. This article will help you shortlist the best 4 GST certification courses in Nashik.

Before getting into the details of the GST Certification courses in Nashik, it is wise to skim through the advantages of GST. Knowing the basics of any subject serves as a foundation stone for gaining further insights into the subject.

Cost reduction: Due to the introduction of GST, manufacturers now only have to pay tax on the value that they add to the product while the tax on the inputs gets paid by the input supplier. It leads to an overall reduction in the cost of goods sold and allows better margin generation by the manufacturers.

The same is applicable for each party involved in the value/supply chain. Therefore, payment of tax only on the incremental value added reduces the cascading effect of the tax, thereby leading to a reduction in cost prices of goods and services.

Ease of tax compliance: A unified tax regime allows all the parties to focus on understanding only one tax concept and its application. The ability to file returns on the centralized filing portals makes it convenient and less procedural for the taxpayers.

Curb on tax evasion: With the new GST network registration, it is now impossible for the suppliers to get their goods and services in the value chain without declaring them on the GSTN. Otherwise, they would not be able to track their supplies at all. As a result, the state and the central government closely monitor GSTN.

Business growth across regions: GST is a tax that is uniform across regions and states. This allows the businesses to grow in any city, state without the bias of choosing the location with lower tax rates. It will thus help the economic growth of every city and will contribute to the development of remote areas.

Boost to domestic goods and services: With the reduction of cost due to the single tax regime, domestic prices will be comparable to imported goods and services. The imported goods will also attract GST, thus allowing fair price play for domestic and international manufacturers.

Improvement in state tax revenues: Compliance has become easier for all parties with a single tax regime. Manufacturers have to only adhere to the unified scheme, which encourages compliance by all the parties, thus ensuring improvement in state tax revenues.

Foreign direct investment: The Central governments’ intention to support business growth and reduce compliance burdens for the manufacturer helps attract foreign companies to India. A cumbersome and complicated tax regime is always a hurdle for new businesses to establish and usher.

Boost in economic growth: Increase in FI, and competitive pricing for domestic manufacturers can lead to growth in employment and improved consumerism, thus driving the Indian GDP upward.

Many offline institutions offer GST certification courses, but due to the pandemic situation, these courses are accessible online. Thus, the article will talk about GST certification courses in Nashik and other cities to cover a wide range of options.

Before looking at our picks of GST certification courses in Nashik, it is imperative to amplify research on topics covered in these courses. Knowing the contents will help you find the course matching your objective.

- Basics of GST: This is self-explanatory. It will target all the basics of the topic, including the GST amendment ACT. What, when, how, and why of this subject will get covered at this stage

- Concept of indirect taxes: This will explain all the indirect taxes, like service tax, excise duty, VAT, and application under the old tax regime.

- Application of GST: This will explain how GST came into effect and how it gets applied. What advantages it provide over the previous tax structure. Applicable sections under the new tax regime will also be covered at this stage.

- Components and subcomponents of GST: Here, concepts like SGST and CGST will be explained. Which component of GST gets applied in which situation will be covered at this juncture.

- GST and price reduction: This will cover aspects of how GST helps reduce the domino effect of tax on the final product bought by the consumer.

- New compliance systems in GST: Apart from an online filing portal, several other portals have been introduced to make goods transport smooth and seamless. This module will talk about everything relating to filing and the related portals.

- Tax invoice: This helps understand the requirements for creating an invoice for goods and services supplied by the supplier. The module will provide details around invoicing and its requisite components.

The contents of most courses are nearly the same across all GST certification courses in Nashik or outside. However, the depth and details of the contents will vary, and it is thus pertinent to know one’s learning objective before making a choice.

Now, before choosing from various GST certification courses in Nashik, you must be sure about your need for learning this topic. Seeking clarity on the objective will help you filter that one course that will serve your purpose just right. Since these courses are not tailor-made, you can only make the most of them by studying the contents covered and selecting the one that matches closest with your underlying motive.

As mentioned before, the GST certification courses in Nashik are also now conducting online coaching. We will, therefore, not only look at the GST certification courses in Nashik but also outside Nashik. It will give you a broader group to look at and not settle with just locally available courses.

Without further ado, let’s look at our top 4 picks for GST certification courses in Nashik.

● IIM Skills:

IIM Skills offers various courses designed with the aid of industry experts, and GST is one such course. IIM Skills offers the best online GST course pan India. It has a comprehensive curriculum, a greatly helpful community, and a support system that assists you even when the course is complete. IIM SKILLS offers courses in various cities including GST Courses in Delhi, Kolkata, Mumbai, and others.

Curriculum:

- Basics of GST and its impact on businesses

- Framework and structure of GST

- GST registration and payment

- Invoicing and e-way bill

- Filling of GST returns

- Accounting records and entries

Course Length: 4 weeks.

Live Classes: 16 hours.

Course Format: Online.

Course Prerequisites: None.

Advantage: This is also a practitioners course but relatively simplified to be taken by individuals with varying backgrounds and objectives.

The theory in this is not as detailed, still, this course is designed to cater to various parties’ practical needs of application and payments, so it works beautifully for most aspirants.

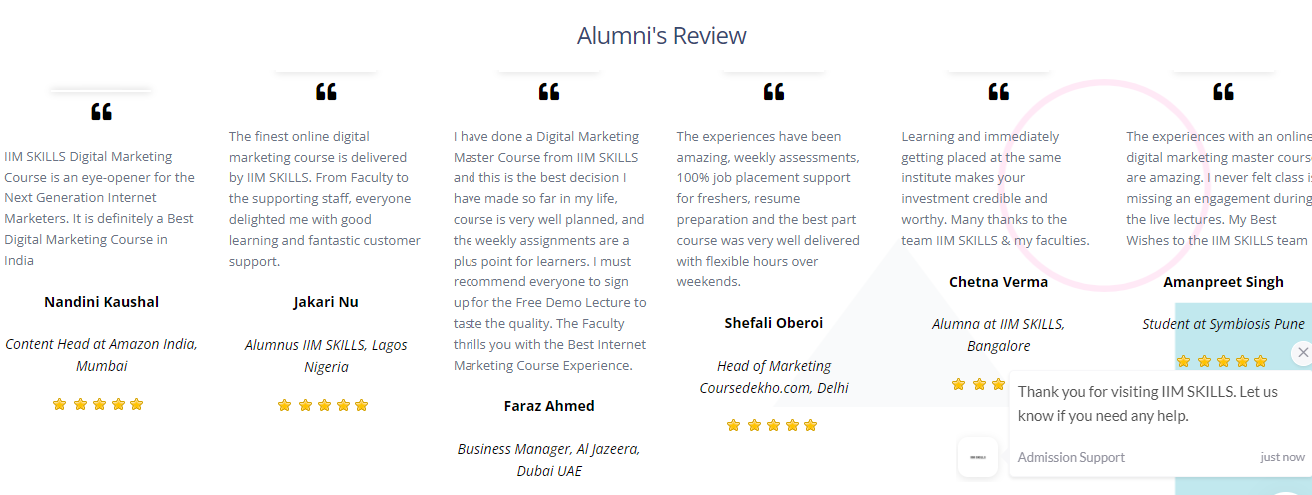

Placement Assistance

Reviews

Why Select IIM SKILLS GST Certification Course?

1. Master Certification

2. Industry – Recognized Curriculum

4. Access to LMS

5. Practical Training and Hands-On Projects

7. Benefits people from diverse walks of life

Course Fee – Rs 9900 (GST excluded)

This form is currently undergoing maintenance. Please try again later.

Check out these professional courses

Business Accounting And Taxation Course

If you are confused on whether to choose offline or online courses, please go through our list of Online GST Courses In India to get more clarity on what course to choose.

● ICA | Near Shahid Circle | Desouza Colony

ICA is one of the GST certification courses in Nashik. It specializes in accounts training in Nashik. It is partnered with National Skill Development Corporation (NSDC). It has been known to have 20 years of experience in the field of accounts. The course also helps in preparing the candidates for interviews and provides 100% job assistance. Following are the course contents:

- Understanding concepts and definitions in GST

- Calculation and payment of GST

- Recording accounting entries for GST

- Filing returns and the online portals to be used for it

- Use of Tally for GST

- Practicing and a project on GSTN

Course Length: 27 hours.

Course Type: Short Term with further deliveries spanning to 3 months.

Course Format: Online. Each session is recorded and thus can be accessed by the student anytime on the E-learning app.

Course Prerequisites: None. Anyone with an HSC certificate can join this course after clearing the entrance test by ICA.

Advantage: You will be provided with a paid internship if your graduation is underway and 100% job assistance for people who have already graduated in any stream.

Disadvantage: Relatively more theoretical.

● ICSI

The course is provided by the reputed institute of ICSI, a government institute. It is needless to say that ICSI can add immense value to your CV if you decide to complete your GST certification course with them.

- Basics of GST

- Concepts and definitions of GST

- Calculation of GST

- Application and filing of GST

- Current GST regime and any updates made to-date

Course Length: 5 weeks.

Course Fees: INR 7500+GST.

Course Format: Online.

Course Prerequisites: You should be a member or student of one of ICSI’s professional courses.

Advantage: It will cover more technical details around sections of the act, which is very important for the student community and anyone planning to set up their private practice.

Disadvantage: It is not open to people who are not part of ICSI, so business people or entrepreneurs might not be able to benefit from this course.

● GST Centre

GST center is known as the hub for learning accountancy and related practices. It is approved by the Ministry of Skill Development and Entrepreneurship, Government of India. It provides three distinct programs for GST. Details of each are given below. It is one of the top GST certification courses in Nashik offering intensive learning and practical training on GST.

- Diploma in GST: This is the first course offered by the institute.

Curriculum:

- Overview of GST

- Calculation and application of tax

- Tax rates and classification

- Impact on accounts

- Payment of GST

- Invoice and e-way bill

- Offenses and penalties

- Assessments and audits

- Purchase, purchase returns, sales and sales returns recording

- Import and export of goods and services

Course Details: The course is broken into beginners, intermediate, and GST in tally modules.

Course Fees: INR 6500 plus charges for attestation.

Course Format: Online and self-paced videos. Offline training is also provided with some extra cost.

Course Prerequisites: None.

Advantage: Attestation by Ministry of External affairs – GOI. It is ideal for students looking to become GST consultants or establish a career in taxation.

Disadvantage: Too detailed for business people and entrepreneurs looking to understand it for application.

- GST Practitioner Course: As the name suggests, the course is tailor-made to help individuals become GST practitioners.

Syllabus Topics:

- GST registration and computation

- File maintenance

- Accounts recording and maintenance

- Filling returns and e-way bill

- Acts applicable under GST, SGST, CGST

- Constant sharing of circulars with updates and amendments made to the act

Course Format: Online and self-paced videos.

Course Prerequisites: None.

Advantage: Certificate by GST center, support in preparing for NACIN exam, which is mandatory for all practitioners to practice GST in India. You will also get community membership and will have access to regular updates and news from GST experts. GST center also issues an ID card that will prove your expertise and experience, which will allow you to conduct training.

Disadvantage: As it is focused on practitioners so it might not be suitable for students or entrepreneurs.

- GST in Business Management: This course is customized to meet the needs of MBA students. The curriculum of the course is similar to the GST Diploma course. Like the GST diploma course, this course is also split into beginners, and intermediate levels, except this, won’t cover the GST in the tally module.

Course Format: Online and self-paced videos.

Course Prerequisites: None.

Advantage: Certificate by Ministry of External Affairs – GOI.

Disadvantage: As this course is customized for MBA students, it is only reasonable to assume that this won’t be as detailed as the diploma course and might not be good for the students or practitioners. To be fair, the course is designed to provide a high-level understanding of the subject to the MBA students to oversee day-to-day operations and related taxation impacts in their jobs which is evident from the course title.

Before choosing any course, please sign up for a free demo class provided by all the course providers to make a well-informed decision.

Frequently Asked Questions on GST Certification Courses in Nashik:

1. Who is eligible to become a GST practitioner?

Any person who is a resident of India, has a graduate degree, has undertaken relevant training, and has acquired NACIN certification, can act as a GST practitioner in India. Further, refer to section 48 of the CGST act to know the eligibility criteria to become a GST practitioner.

2. How much does a GST practitioner earn?

The annual salary for a GST practitioner ranges from 4.5 to 9.5 lakhs. However, it varies from area to area, and the company one works for. It is also vital to understand that packages vary based on the experience and skills displayed by the individual.

3. Can a GST practitioner do a job?

Yes. GST practitioners can also do a job and perform the duties required as a representative of the corporate they join. Alternatively, they can establish an independent practice catering to various clients.

4. Can one file own GST returns?

Yes. Taxpayers can file their returns on the online filing portal. One can follow the step-by-step process available on various websites for filing returns. After doing any of the certificate courses, this will be much easier. That is why many entrepreneurs and business people join GST certification courses in Nashik or outside.

5. What is the frequency of filing GST returns?

GST returns need to be filed monthly or quarterly, depending upon the type of return. The due date for each type of GST return ranges between 10-15 days post the completion of the previous month or quarter.

Concluding thoughts on GST Certification Courses In Nashik

To conclude, there are many GST certification courses in Nashik. This article has surely filtered some of the best in the industry. Now which certificate course you pick is completely driven by your objective and your desire for an offline or an online course. If you wish to take an offline course, you will have to opt for GST certification courses in Nashik alone.

But if you decide to take an online course and learn everything from the comfort of your home, there are many more options available to choose from. Furthermore, if you are a professional, an online course will be highly convenient for you as it will be available on weekends. Therefore, it allows the professionals to have an undisturbed work schedule while still learning new things.

If you are a student, joining an online course gives you many options to choose from and not settle with GST certification courses in Nashik alone. This article in no way undermines the courses available locally, but since most local providers are also online, it removes the location bias for anyone opting for the course.

An online course is the best option as business people have a very busy schedule, and an online course that provides access to recorded videos is ideal. In addition, online courses allow that self-paced learning which is very important for business owners and entrepreneurs.

In a nutshell, be clear with your motive for joining the course and then choose the course that does not interrupt your existing study/work schedule and allows you to gain practical and theoretical knowledge on the subject of GST.